For any individual investor considering high yield, and high credit risk bonds, defining your universe is a great starting point.

Our definition of a high risk bond is any issue with a non-investment grade rating from either S&P or Moodys.

The next step is to eliminate bonds you won’t buy. We drop the following to create our Universe:

- Any bond with less than $100,000,000 outstanding.

- Any bond with less than $500,000,000 that has traded fewer than 10 times per day over the past two months.

Here’s why:

- The yield of a bond indicates of the amount of credit risk the market believes that bond contains. Hence the convention of equating high yield with high risk.

- In order for that yield to be a useful indicator, it needs to be current and represent a reasonable consensus. A single level from a month ago is not a great indication of what buyers and sellers would collectively agree on today. Likewise, it’s hard to put much faith in one print today for the first time in months since erroneous trade levels can be revised days later.

- While $100,000,000, $500,000,000, 10 trades and 2 months are somewhat arbitrary lines, bonds that make this cut can reasonably be said to have clear, current yields that represent a consensus of market participants.

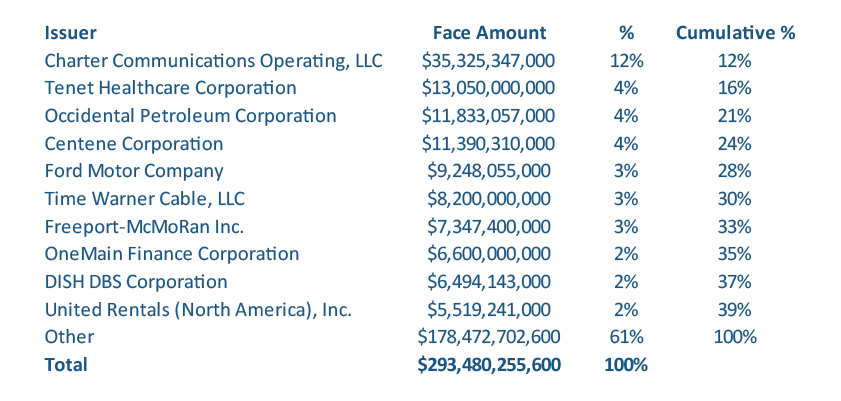

Where does that leave us? As of April, 2024, there were just under $300bn of bonds registered with the SEC and rated non-investment grade by S&P or Moody’s with the top ten issuers accounting for 39% of face value:

SEC Registered High Bond Face Value- Selected Universe

SEC Registered High Bond Face Value- Selected Universe

SEC Registration

Only corporate bonds registered with the SEC may be purchased by all individual investors. Registration requires issuing companies to file regular, public disclosures including quarterly financial statements in the SEC’s EDGAR system:

Regarding corporate defaults, S&P published their Global Corporate Default Study for 2023:

Default, Transition, and Recovery: 2023 Annual Global Corporate Default And Rating Transition Study

Eleven issuers of SEC registered non-investment grade bonds defaulted last year representing a face value of $9.6bn with a weighted average recovery of 29.6%. Outstanding bond amounts in the table below are lower than total debt figures listed by S&P which include loans and private placements. Recovery rates are weighted averages of the last known bond prices based on research by GoodFill. Silicon Valley Bank is excluded from the list of non-investment grade defaults since it was investment grade from both agencies until two days before it defaulted:

2023 SEC Registered Non-Investment Grade Bond Face Amount Defaults by Issuer

2023 SEC Registered Non-Investment Grade Bond Face Amount Defaults by Issuer

The 2023 defaulted face amount represents 3.25% of the current SEC registered non-investment grade Universe as defined above.